utah restaurant food tax rate

With local taxes the total sales tax rate is between 6100 and 9050. The restaurant tax applies to all food sales both prepared food and grocery food.

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

The St George Utah sales tax is 635 consisting of 470 Utah state sales tax and 165 St George local sales taxesThe local sales tax consists of a 010 county sales tax a 100 city sales tax and a 055 special district sales tax used to fund transportation districts local attractions etc.

. This page discusses various sales tax exemptions in Utah. Utah sales tax sales taxes are applied to a variety of goods including tangible personal property transportation services hotels and food. Utah has recent rate changes Thu Jul 01 2021.

Utah has state sales tax of 485 and allows local governments to collect a local option sales tax of up to 335. It is assessed in addition to sales and use taxes on sales of food prepared for immediate consumption by. Report and pay this tax using form TC-62F Restaurant Tax Return.

Exact tax amount may vary for different items. KUTV Tax complexities in Utah impact what you pay for what you eatAt the Capitol on Wednesday A legislative committee heard about nuances in applying Utahs food taxIt seems complicated said. Back to Utah Sales Tax Handbook Top.

Used by the county that imposed the tax. Bundled transactions of food and food ingredients and tangible personal property items are taxable in their entirety at the standard 475 rate. Instead of exempting food and food ingredients from Utah sales and use tax as originally planned the law taxes them at a reduced rate of 275.

The utah sales tax rate is currently. See Utah Code 59-12. The St George Sales Tax is collected by the merchant on all qualifying sales.

Depending on which county the business is located in the restaurant tax in Utah can range from 610 to 1005. The restaurant tax applies to all food sales both prepared food and grocery food. Connecticut In Connecticut food sold by eating establishments or caterers are subject to sales tax Effective October 1 2019 the Connecticut sales and use tax rate on meals sold by eating establishments caterers or grocery stores is 735.

The state provides a guidance page with plenty of examples on what is and what is not considered prepared food in Utah. In resort communities the Resort Exempt rate is the Combined Sales and Use. The rates under Transient Room Prepared Food and Short Term Leasing include the applicable Combined Sales and Use tax rate.

For example the rate of 1282 applies to the total taxable transient room charges in West Haven City. Both food and food ingredients will be taxed at a reduced rate of 175. With local taxes the total sales tax rate is between 6100 and 9050.

There are a total of 131 local tax jurisdictions across the state collecting an average local tax of 211. In the state of Utah the foods are subject to local taxes. Restaurants must also collect a 1 percent restaurant tax on all food and beverage sales.

For example a bagel sold without utensils is considered a grocery item and taxed at the reduced 3 rate. Utah Restaurant Tax. The state sales tax rate in Utah is 4850.

Based off of Utahs current sales tax rate on unprepared food of 175 Berni probably pays around 1925 a month in sales tax on food. Only one rate will apply to a single transaction. 2021 utah state sales tax.

91 rows This page lists the various sales use tax rates effective throughout Utah. Location Code Sales and Use Food Room Restaurant Leasing Exempt Beaver County 01-000 635 300 1092 735 885 Beaver City 01-002 735 300 1192 835 985. With local taxes the total sales tax rate is between 6100 and 9050.

While the Utah sales tax of 485 applies to most transactions there are certain items that may be exempt from taxation. This is the Connecticut state sales tax rate plus and additional 1 sales tax. Groceries are generally defined as unprepared food while pre-prepared food may be subject to the restaurant food tax rate.

111 s university ave provo utah 84601 main phone. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Food food ingredients and prepared food sold in restaurants remain.

However in a bundled transaction which involves both food food ingredients and any other taxable items of tangible personal property the rate will be 465. Bars and taverns in Utah are also subject to restaurant tax on food sales and beverages including beer and liquor. Utah specifies that prepared food is considered ready to eat or sold with utensils.

The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. Counties may adopt this tax to support tourism recreation cultural convention or airport facilities within their jurisdiction. With the rate restored to the full 485 Berni will likely spend around 5335 in state sales tax a month or about 3410 more.

2022 Utah state sales tax. The Utah state sales tax rate is 595 and the average UT sales tax after local surtaxes is 668. To find out what the rate is in your specific county see Utahs tax guide.

But a bagel sold with utensils is considered. This is the total of state county and city sales tax rates. Average Sales Tax With Local.

Only one rate will apply to a single transaction. See Utah Code 59-12. 675 Is this data incorrect The Kaysville Utah sales tax is 675 consisting of 470 Utah state sales tax and 205 Kaysville local sales taxesThe local sales tax consists of a 155 county sales tax and a 050 special district sales tax used to fund transportation districts local attractions etc.

Counties and cities can charge an additional local sales tax of up to 24 for a maximum possible combined sales tax of 835.

Utah Lawmakers Are Discussing An Increased Tax On Food Here S What That Means Kutv

Utah Sales Tax Small Business Guide Truic

Utah Lawmakers And Community Members Want To End The Sales Tax On Food Items Kuer

Tax Flyers Tax Prep Accounting Services Tax Preparation

Sales Tax On Grocery Items Taxjar

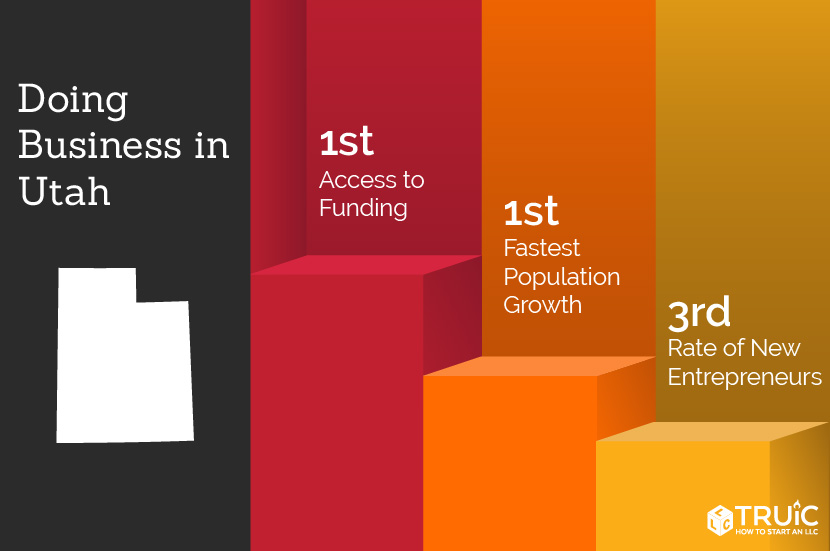

How To Start A Business In Utah A How To Start An Llc Small Business Guide

What Is The Restaurant Tax In Utah Santorinichicago Com

States With Highest And Lowest Sales Tax Rates

Is Food Taxable In Utah Taxjar

How Much Is Restaurant Tax In Utah Santorinichicago Com